TrendForce:2012 December LED Light Bulb ASP Continued a Mild Sequential Drop

According to LEDinside, the LED research division of TrendForce, the ASP volatility of LED light bulb has been continued into December 2012. Products from the US took the led as more new items were launched during the month. ASP for those LED bulbs targeted to replace the traditional 40W incandescent light bulb posted a mild 0.2% sequential gain to US$18.70. And those targeted to replace the 60W incandescent lamp posted a 3.9% drop to US$30.90 in the same period.

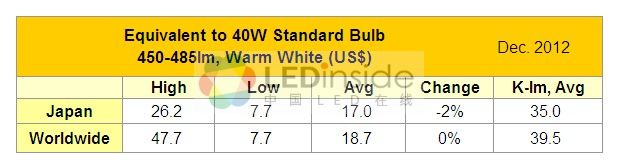

ASP of LED for 40W incandescent bulb replacement up 0.2% to US$18.70

Breaking down by region, LEDinside observes that those LED bulbs for 40W incandescent bulb replacement posted a respective gain of 4.6% and 5.9% in England and Germany, thanks to the mild ASP growth plus weaker currency against US dollar in the regions. Korean vendors saw a mild 1.1% ASP gain, pretty much driven by a weaken Korean won. ASP for most items maintained flat with limited new products launch though. Korean vendors such as Samsung and LG still have their products priced at lower ASP level, the research firm indicated. In Japan, a mild 1.9% drop is observed because of a stronger yen and an absence of new items. Among all, US led price drop among all with an 8.1% sequential change reported amid launch of cheaper-price items.

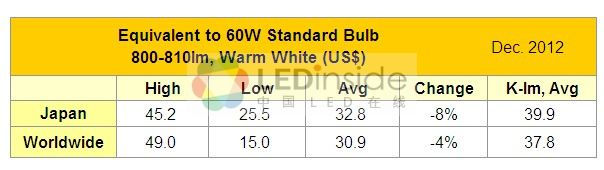

ASP of LED for 60W incandescent bulb replacement down 3.9% to US$30.90

In the 60W replacement segment, US again led the drop with a sequential ASP decline of 13.4% reported. While most current items priced lower, new brands such as Samsung also launched competitive pricing at the region. In Japan, ASP dropped by 7.7% to US$32.80. A stronger yen is the key reason for the price drop, while most current items have also priced lower in December. No new items have been launched last month, LEDinside observed. Korean vendors, on the other hand, managed to post a mild 1.1% sequential ASP gain. Still, a weaker Korean won is the major reason, plus a mild price revision at the region. British vendors also saw a mild ASP gain of 4.1%, thanks to price revision of current products and a weaker pound trend. Germany posted a 3.2% sequential drop because some high ASP items were absent temporarily while existing products faced a mild ASP volatility.

Aggressive pricing from Korean vendors helps to flourish the industry

The sharp ASP drop in the US market in December is a joint result of a further price revision and a competitive pricing from new products. LEDinside observes that new products from EcoSmart and Samsung both offered competitive prices in the US. Of which, Samsung has launched the 810 lumen 10.8W LED bulb for 60W incandescent bulb replacement in the European market. ASP of such item is only US$15 in the US market in December, a price range which is among the lowest of all major brands in the region. Since domestic competition intensifies as market matures, Korean vendors, who eye on the business potential in the European and US markets, thus launch aggressive pricing strategies in order to grab bigger share, LEDinside indicated. This strategy should help diversify the product variety and further intensify competition, in turn results in prosperity.

Along with the ban of sales of incandescent bulb from January 1, 2013 in all European Commission countries, corresponding impetus to drive the LED bulb replacement should be strengthened. As the debt crisis seems putting on a temporal breath, consumers should again grow their acceptance and consumption power for LED bulb, LEDinside believes. The whole LED market should materialize with more healthy competition and development, the firm noted.